Banking Information Management

You must have one bank account on file (known as the primary bank account) and can have a total of two bank accounts for each employee number. Banking changes must be entered prior to Monday at 5:00 p.m. to be effective for the current week's deposit. (Where a Statutory Holidays falls on Monday, banking changes must be entered prior to Tuesday at 5:00 p.m.).

To change, add or delete information regarding bank account information (Direct Deposit), select Banking Information in the myPAY toolbox.

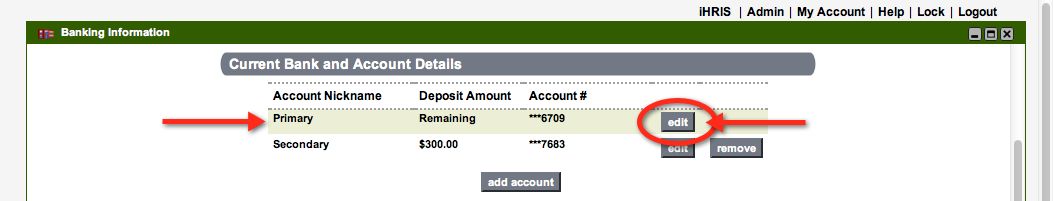

Upon launching the Banking Information link, your current banking information will be displayed as a read-only form.

TIP: Hover the cursor over a field and a Help Box will appear to give additional information about that field.

Top of Page

Edit an account

Click edit to update your banking information.

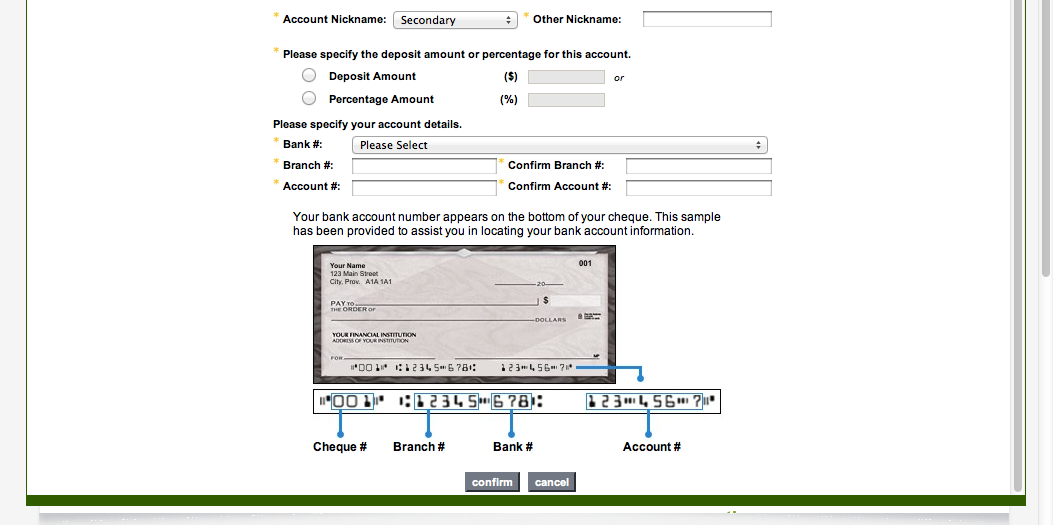

Upon clicking edit, the banking information form will open below and you can complete the fields as required. All fields with a yellow asterisk* are required fields. These cannot be left blank. If a mandatory field is left blank, a message will pop up asking you to complete the required information.

Once you have completed your updates, select confirm to have your changes processed. You will then be re-directed to view your information in a read-only format.

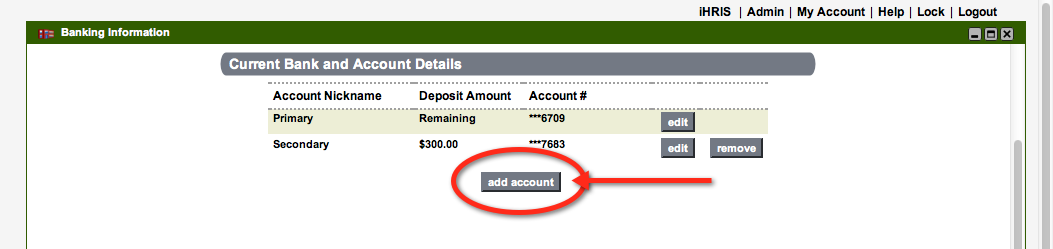

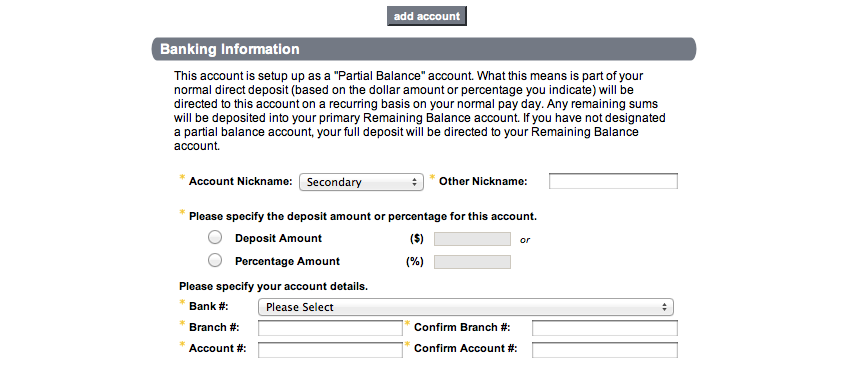

Add an account

Select add account to add additional bank accounts to your existing banking information, for a maximum of three accounts. Additional accounts are setup up as Partial Balance accounts. This means part of your normal direct deposit (based on the dollar amount or percentage you indicate) will be directed to this account on a recurring basis on your normal pay day. Any remaining sums will be deposited into your Primary Remaining Balance account. If you have not designated a Partial Balance account, your full deposit will be directed to your Primary Remaining Balance account.

Complete the fields as required.

To indicate a specific dollar amount you would like deposited into this account each pay period, click the button to the left of the Deposit Amount field and then enter the dollar amount, to the nearest dollar, in the field.

To indicate a percentage amount your would like depostied into this account each pay period, click the button to the left of the Percentage Amount field and then enter the percentage amount in the field.

Should you have more than one bank listed, the system will satisfy the secondary bank(s) (% or $) as per the criteria you have set up and then the remaining amount will be deposited in the Primary Bank Account.

All fields with a yellow asterisk* are required fields. These cannot be left blank. If a mandatory field is left blank, a message will pop up asking you to complete the required information. An information message will trigger if there are formatting errors in the field (e.g. a field requires a five-digit branch number for banking information and you have input seven numbers. The error message will generate to notify you that the format put in does not match the format requirements, and that only five digits are required in this field.)

Once the required fields have been completed, click Confirm and your changes will be saved. You will then be re-directed to view your information in a read-only format.

Once the required fields have been completed, and you are ready to submit your account information, select confirm to have changes processed.

Top of Page

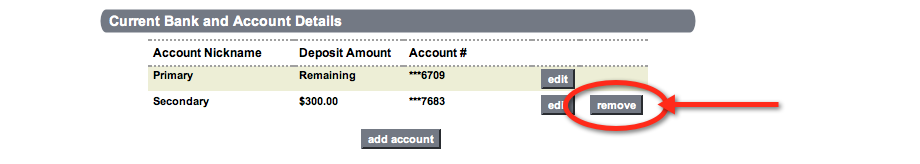

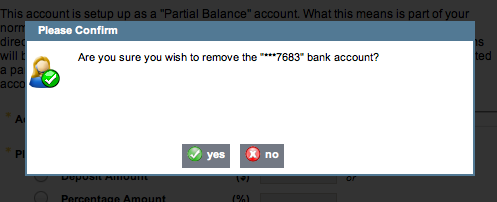

Remove an account

Select remove to delete a bank account from your profile. A message will appear asking you to confirm that you wish to remove the account. Choose yes or no to complete the transaction. If you choose no, no changes will be made and you will be re-directed to view your current information as a read-only form. If you choose yes, the bank account will be removed from your profile and no further payroll deposits will be made to that account.

TIP: You will not be able to remove a bank account that has been identified as Primary. If you need to change the details of your primary account, select edit and update as required.

Top of Page

Garnishments

In the event that you have a garnishment set up through payroll, banking information can only be edited directly into the payroll system and therefore banking information change requests must be directed to the HR/Payroll department who will make the changes on your behalf.

Below is what is presented when a garnishment is in place; data is read only.

All changes made within Gateway Online will flow to iHRIS and update Payroll/HR records with in iHRIS

There is no workflow or notification generated from this transaction.

Top of Page